If your company exports internationally, you are probably familiar with the various obstacles that products may encounter when arriving at customs. In this article we are going to focus on the TARIC code, how it is verified and what is the purpose of the different codes.

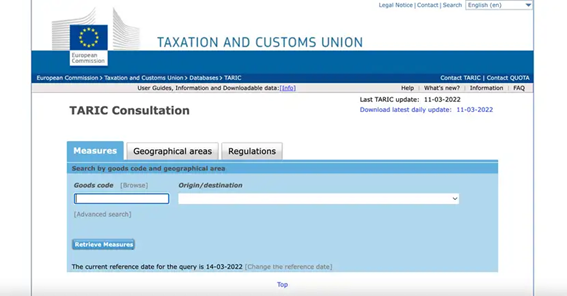

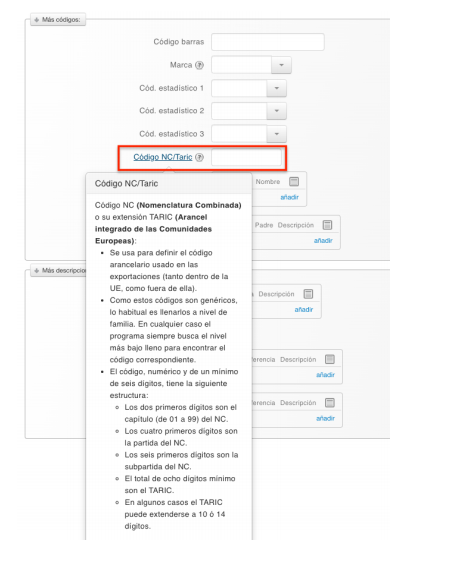

The TARIC code is a tariff classification system used by the European Union to classify products that are imported or exported from European territory. The codes can be consulted on the official portal of the European Commission at the following link https://ec.europa.eu/taxation_customs/dds2/taric/taric_consultation.jsp. A TARIC code is a series of, generally, 10 digits.

TARIC stands for “Tarif Integré Communautaire” which means in English “Integrated Tariff of the European Communities”.

How to find TARIC product codes

To obtain or check the TARIC code of your products, simply enter the generic name of your product or the material it is made from on the official portal mentioned above.

The system helps you find the most accurate representation of your product through a hierarchical system.

Try to choose the most appropriate code. Otherwise, customs clearance could be delayed, resulting in additional costs, or the goods could be retained or discarded.

TARIC codes are mainly used in the European Union. For shipments to the UK, US or Russia, it is best to use the HS code.

What happens if the wrong code is used?

Using the wrong code can cause delays. For example , if you use a TARIC code that applies a 0% tariff rate to an item that should have been charged, you will likely face a delay and additional customs clarification may be required.

Purpose of TARIC codes

The TARIC code is used to set tariffs on products being shipped.

The different customs offices will determine if the TARIC code you have assigned to your products is correct and if you must pay any additional duties or taxes before the goods can be delivered. In order to speed up customs procedures as much as possible, it is necessary to include in the proforma invoice the TARIC code of each merchandise to be sent. And in this way avoid unexpected charges.

Apart from the calculation of customs duties, the TARIC code is used to verify possible restrictions or additional requirements on the entry of goods into European territory or at the country of destination, if it is an export from Europe. Imported goods may, for example, be subject to trade defence measures such as anti-dumping, anti-subsidy and safeguard measures which entail the payment of an additional tariff. A very recent example is the new restrictions by the European Commission on Russia. In particular, with the introduction of the 7th package of sanctions on Russia in July 2022, a new ban on the purchase, import or transfer of gold or jewellery from Russia was imposed and within the 8th package of sanctions against Russia, the EU announced an import ban for steel products originating in Russia or having been exported from Russia. Also, new restrictions were imposed on importation of paper, cigarettes, plastics or cosmetics.

Finally, with the TARIC code you can check the existence of preferential agreements and customs unions that the EU has established with third countries. Two types of preferential tariff rules can be distinguished: 1. Those of an autonomous nature, defined unilaterally, such as those applied by the European Union in its generalized system of preferences (GSP), and 2. those of a bilateral nature, which are usually framed in the context of EU free trade agreements (e.g. with Mexico, Chile, South Africa etc.). Each preferential agreement has its own rules of origin contained in a separate protocol that is structured in general or articulated provisions and a list rules.

A very recent example of preferential tariff duties is the Agricultural Agreement between the EU and Morocco for the application of reduced tariffs on the import of tomatoes from Morocco to European territory. However, preferential customs duties are applied only up to a maximum amount that can enter with reduced tariffs, which is called the established tariff quota. This is a measure which allows total or partial exemption from the payment of tariffs on imported inputs within quantitative limits, where there is insufficient Community production to meet the demands of the Community industry. Thus, in our example of tomatoes from Morocco, these imports of tomatoes can exceed the limits set by the tariff quotas without problem, but beyond that ceiling they do not benefit from preferential treatment with lower tariffs but are subject to the normal customs duty. European Council Regulation 2021/2283 is the legal basis for the opening, providing and managing the autonomous tariff quotas of the Union for certain agricultural and industrial products (Official Journal L 458 of 22.12.2021, p.33). This Regulation establishes the list of goods subject to these measures. It is regularly amended (in January and July each year) to take into consideration new requests presented by the Member States.

The aim of the TARIC system is to harmonise freight transport in the European Union according to a common system. All products use the same system, so they are described and identified in the same way.

It is important to remember that this tariff code must be accompanied by a commercial invoice showing a detailed description of the goods. In it must work the content of the shipment, the material of which it is composed and the use that will be given.

Applicable Regulations

It is the Article 56 of European Regulation No 952/2013 of the Parliament and of the Council of 9 October 2013 laying down the European Union Customs Code. In addition, Council Regulation 2658/87 of 23 July on the tariff and statistical nomenclature and the Common Customs Tariff and Commission Implementing Regulation 2016/1047 of 28 June 2016 amending Annex I to Council Regulation 2658/87 on the tariff and statistical nomenclature and on the Common Customs Tariff apply.

In Navas & Cusí Abogados, we are proud to offer our clients a service of advice on investments and commerce at a national and international level. With a team of expert lawyers in international law, we focus on guaranteeing the best investment for our clients. Contact us to receive assistance and ensure a successful future for your investments.