Introduction

Belgium is ranked 45th out of 190 countries in the “Doing Business” ranking, which classifies countries according to the ease of doing business, being the 25th largest economy in terms of GDP. The Belgian economy is currently oriented towards the service sector, with a more dynamic economy in the Flemish part and a more ruralized economy in the Walloon part.

On 28 February 2019, the Belgian parliament approved the new Companies and Associations Code. The regulation entered into force on 1 May 2019 and every company incorporated as of that date is subject to the new code. For existing companies, the code applied from 1 January 2020, with a deadline of 1 January 2024 to adapt the current company statutes. In the following article we will analyze the different types of companies existing in Belgium, the way to incorporate and register a company, and the tax obligations to which they are subject.

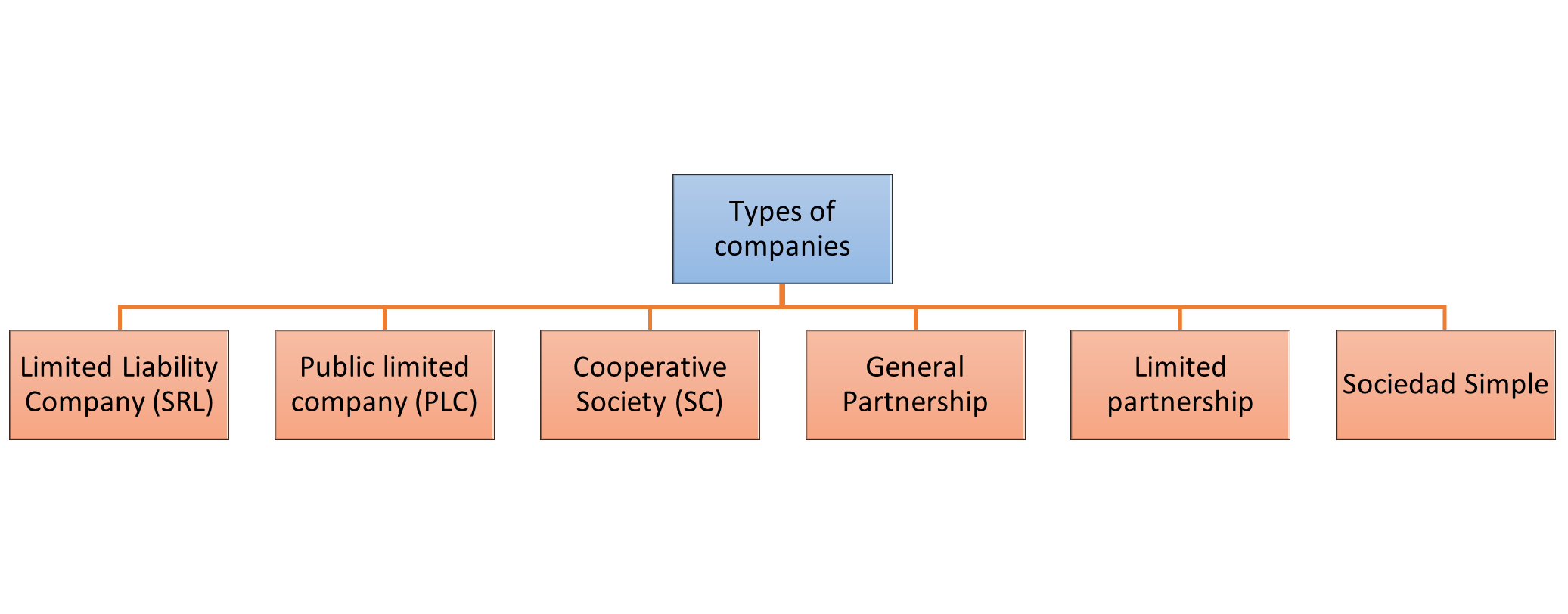

Types of Companies

The Limited Liability Company (SRL)

The Limited Liability Company (SRL), which entered the Belgian business landscape on 1 May 2019, is the successor to the Private Limited Liability Company (SPRL). It is the reference company for small and medium-sized enterprises. It can be formed by one or several partners. There is no minimum capital requirement, but it must be sufficient for the intended activity. The limited liability company has its own legal personality, therefore the shareholders are only liable for the amount of their contributions.

Public limited company (PLC)

The public limited company (PLC) is a form of company chosen mainly by large companies. At least two members are necessary to establish this company structure in Belgium. Shareholders must provide a minimum capital of EUR 61,500. Shareholders contribute to the company’s capital in exchange for shares and must provide at least 20% of the money prior to the company’s registration. This form of company must be incorporated by a notarial act.

The cooperative society (SC)

The cooperative society is a legal form in which the members pursue a common goal. Therefore, a minimum of three founders is required. The main objective of this type of company is to satisfy the common needs of the shareholders, but also to develop their economic and/or social activities. This cooperative objective must be defined in the statutes of the company. No minimum capital is required to create a cooperative company, but each founder must make a contribution. The liability of the shareholders is limited to their contributions.

The general partnership

The general partnership is concluded between partners who are liable indefinitely and in solidarity. All decisions must be taken unanimously unless the agreement specifies that decisions are taken by a majority vote.

Limited partnership

A limited partnership consists of one or more partners who are liable indefinitely and in solidarity and who are called “general partners“, and one or more partners who merely contribute with capital and who are called “limited partners“. The general partners are responsible for the management. All decisions must be taken unanimously unless the agreement specifies that decisions are taken by the majority.

Incorporation of Societies

The formalities for the incorporation of a company can be broken down into three stages: establishing the constitution act, presenting the constitution act and registration the constitution act.

Establish the constitution act

The first formality is to draw up a written act of constitution. These are the statutes of the company in which all its characteristics (name, registered office, object, capital, etc.) are recorded and its operating procedures. The constitution must include the following information: the name of the company, the legal form of the company, the address of the registered office, the object, the duration of the company, the modalities of representation of the company, the capital, and the values of the company. Furthermore, a financial plan is essential that justifies the amount of capital or contributed, and provides an estimate of the expected income.

Depending on the type of company, this document may take the form of a notarial document (public deed) or a private deed. If you choose the legal form SRL, SA, or SC you must go to a notary to write the incorporation deed of the company, however if you opt for a SNC, or SComm is enough with a private deed.

Presenting the constitution act

Once the act of incorporation has been drawn up, the act of incorporation must be presented in the register of the Commercial Court where the company has its seat. In the case of the SA, the SRL and the SC, the deposit is made by the notary and the deed is registered in the Registry of Moral Persons. The notary can carry out the procedures of the presentation of the constitutive act by electronic means, which accelerates the process. In the case of private deeds, the partners are responsible for making this deposit.

Once the act of incorporation has been presented, the court clerk (“greffier“) enters the company identification data at the ECB (Banque Carrefour des Entreprises). The same judicial secretary, publishes the Constitution in the “Moniteur Belge” (Belgian Official Gazette).

Registering the constitution act

The constitution act of a company must be registered at one of the FPS Finance registration offices (Land Registry Administration, Land Registry and Property Registry). In the case of a notarial deed, the registration must be carried out by the notary within 15 days. In the case of a private deed, the partners of the company must register it within four months, paying in any case the registration fees.

Opening a bank account

When incorporating a company, you must open a current account in a bank or other financial institution, preferably a professional bank account in the name of the company. You must include this account number on all the business documents (letters, invoices, etc.) with the company number, the name of the company and the name of the financial institution. There are several Belgian and foreign banks operating in Belgium, mainly due to the high number of expatriates residing in the country.

Registering the company

The “one-stop shop” or “guichet d’entreprise” is the central contact point for all administrative formalities related to the start-up of the company. Currently, eight organizations are accredited as “guichet d’entreprises” and you are free to choose any of them: Acerta, Eunomia, Formalis, Liantis, Partena, Securex, UCM, and Xerius.

The “guichet d’entreprise” performs various tasks such as registering the company with the BCE (Banque Carrefour des Entreprises), certain administrative formalities, or applying for various permits. A company is registered with the BCE at the time of filing the articles of incorporation as described in section 3.2 above. At the same time, it is assigned a company number, which will be a definitive and unique number. The company must then go to a “guichet d’entreprise” or “one-stop shop” to register the company with the ECB as a company subject to registration. If the “guichet d’entreprise” refuses to register the company as a company subject to registration with the ECB, an appeal may be lodged with the “Conseil d’Etablissement” of the competent region. The cost of registration with the BCE is 92.50 euros, including one unit of establishment, plus 92.50 euros per additional unit of establishment. These are the prices applied at the beginning of 2022 which are indexed annually. Briefly, it is worth mentioning that the “Banque Carrefour des Entreprises” is a database containing all the identification data of registered entities and their units of establishment, both legal entities and natural persons exercising a professional activity on their own account.

In the event that a foreign entity wishes to carry out activities in Belgium and establish itself there, there are several possibilities: create a branch, a subsidiary or an establishment unit. Legally, a branch is not a separate entity from the company. The branch and the foreign entity are one and the same entity. The entity establishing a branch in Belgium receives, if it does not already have one, a company number. This number is communicated by the clerk of the competent Commercial Court when filing the application. It must then apply to the “guichet d’entreprise” of its choice for registration with the ECB.

In the case of the subsidiary, it is a separate entity from the foreign entity. It has its own legal personality (unlike the branch), the legal form being a company under Belgian law. In addition, the subsidiary established in Belgium obtains a company number when it is registered with the ECB by the notary or the clerk of the competent Commercial Court and must then apply to the “guichet d’entreprise” of its choice for registration with the ECB.

Finally, some foreign entities may operate from an address in Belgium without having a branch or subsidiary. In this case, these entities carry out their activities in Belgium from an establishment unit (e.g. workshop, factory, store, point of sale, office, etc.). In case of a change in the company’s status, you have one month to apply for a modification of the registration as a company subject to registration.

Taxation

VAT (TVA) and obligations

If the company supplies goods or services covered by the VAT Code (TVA Code) on an independent and regular basis, it is subject to VAT. If the company carries out certain activities exempted under Article 44 of the VAT Code and provided that certain conditions are met, the company is subject to VAT but does not have to invoice VAT to its customers, and furthermore does not have to be identified for VAT purposes. These are, for example, certain social or cultural, financial or medical activities. The same applies to foreign companies, which must identify themselves for VAT purposes when they carry out transactions in Belgium covered by the VAT Code.

In terms of obligations, a company subject to VAT has certain obligations (with the exception of those carrying out transactions exempted under Article 44 of the VAT Code), such as making VAT returns, paying to the Treasury the VAT invoiced to customers, transmitting an annual list of customers, keeping accounts and submitting invoices.

Different VAT regimes

The normal regime applies to all VAT taxable persons who do not benefit from another regime. Businesses must file a monthly return for the previous month’s transactions. Businesses whose annual turnover does not exceed €2,500,000 excluding VAT may submit a quarterly return (exception: the maximum limit is €250,000 excluding VAT for the supply of energy products, mobile telephone equipment, computers, accessories and components, and motor vehicles subject to registration regulations).

The application of the normal VAT regime entails a number of tax obligations. In order to reduce these obligations, small businesses may opt for certain special regimes known as “régime de la franchise de la taxe“, “régime forfaitaire” or “régime agricole“, depending on their annual turnover and the sectors in which they operate.

Tax obligations

| Taxes | |

| Concept | Tax rates |

| Corporate Income Tax | The company is taxed on the total amount of its profits, i.e. on the net amount of its income. The rate is 25% (as from tax year 2021). Certain sectors of activity benefit from reduced rates. |

| Property Tax | Also called “précompte immobilier“. Since January 1, 2017, the basic withholding rate is 30% of income. Depending on the type of income, reduced rates apply. |

| Indirect Taxes (VAT – TVA) | Rates are set by Royal Decree. The standard VAT rate is 21%.

For certain goods and services a reduced rate is applied: 0%: e.g. certain periodicals 6%: e.g. foodstuffs, water, medicines, books, transport, etc. 12%: e.g. catering, supply of social housing, margarine, etc. |

| Regional Property Tax | This is the regional “précompte immobilier” tax.

– In Wallonia and Brussels-Capital: 1.25% of the cadastral value. – In Flanders: 2.5% of the cadastral value. |

Other considerations

Having analyzed how to incorporate a company in Belgium, and the taxation applicable in each case, it is necessary to point out certain considerations when starting a company. For example, according to the Belgian Law of July 17, 1975 on the accounting of companies, all companies operating in Belgium must have an accounting system, whose obligations may vary depending on the number of employees and turnover, among others. In addition, there are several compulsory insurances that will depend on the sector in which the company operates, such as an insurance against fire or natural catastrophes, insurance against risks of accidents at work for the personnel, ect. In addition, in the case of hiring personnel within the company, a series of administrative formalities imposed by social and fiscal legislation will have to be carried out.

Finally, there are different possibilities in terms of financing and aid for the establishment of companies in Belgium, which will depend on the region (Brussels, Walloon or Flemish) in which the company is located, as well as the possibility to apply for various financial aid from the European Union such as the “COSME” program or the “Horizon 2020” program.